Flip Orders: Concentrated Liquidity on CLOBs

LP with AMM-style simplicity and control on order books

In traditional finance, providing liquidity has always been reserved for the big players. To compete you need special access, custom infrastructure, and capital.

Crypto flipped that idea with AMMs. Anyone could LP. No permission, no barriers: just connect your wallet to deposit and start earning.

With on-chain CLOBs, that simplicity disappears. We reap the benefits of a more efficient market, but inherit the properties that make providing liquidity hard.

That’s why we built Kuru Vaults. They make it simple to LP by combining an AMM with the order book. But what if you wanted more precision?

Introducing Flip Orders

Flip orders are a new type of limit order that automatically ‘flips’ liquidity on the opposite side of the book after each fill. Think of it like setting a post-fill action for your order.

Here’s how it works:

Let’s say you place a bid at $99 and set a flip price at $101.

When your $99 bid fills, instead of giving you the asset, we instantly place a sell order at $101.

When the $101 ask fills, we flip it back into the $99 bid.

This cycle continues every time the order fills. Hence the name, flip orders.

We simulate the feel of concentrated liquidity without requiring frequent cancelling and posting of orders on the book.

Each fill is treated independently and flipped as soon as it’s matched. Orders stay passive and follow price-time priority like any other limit order.

This provides fine-grained control like CLMMs (ex: Uniswap v3) directly on the order book.

Placing Concentrated Liquidity on Kuru

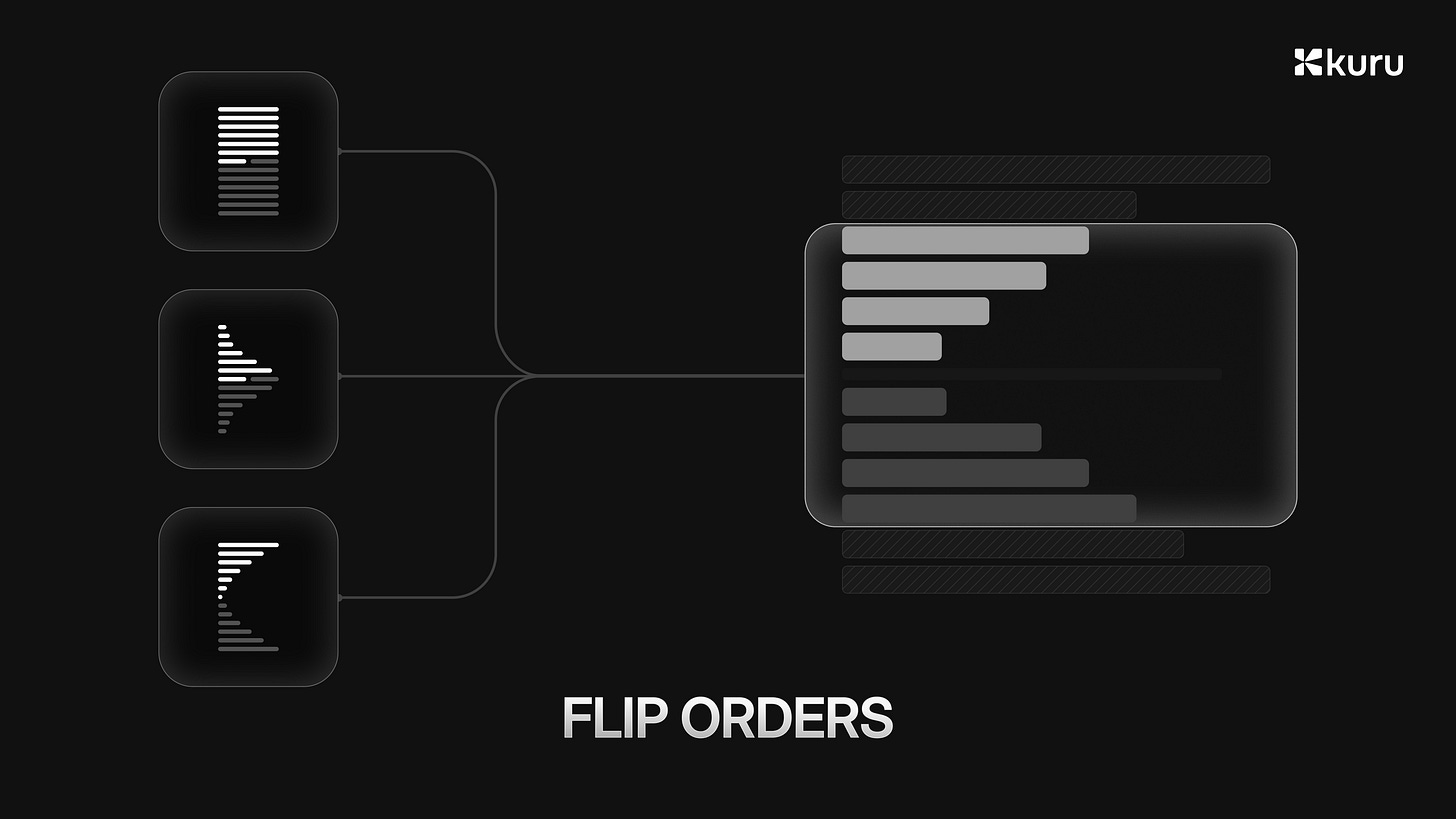

With flip orders, creating a custom liquidity position is simple. You can batch multiple flip orders to build concentrated liquidity across any range you choose.

Here’s how it works:

Choose your liquidity shape - Spot, Curve, or Bid/Ask.

Set your fee by adjusting the spread between your flip prices

Choose how much liquidity to provide

Pick your price range on the chart

Deploy the liquidity in one click.

Your position earns fees when your orders get filled within the selected price range.

Why Flip Orders Work?

Flip orders make LPing on the order book accessible to everyone. You do not need custom infrastructure or active management. They work especially well for pairs like LST/native or stable/stable, where tight price ranges reduce the need for professional market makers.

Orders stay live on the book with no need for constant updates— just set your range and let it earn. Liquidity remains on the book with no fragmentation.

Flip orders take us one step closer to making LPing on order books as accessible as it is on AMMs.

You get control, flexibility, and transparency, without needing to run bots or manage complex strategies.

This new DeFi primitive is now live on Kuru. Try it out and let us know what you think. We’d love your feedback!